A digital media company was bought in 2022 for $50 million. Then in 2025, the purchaser sold it for $9 million. Over 80% of the value vanished. “We later realized that we could do brand building anyway without having to own a media company,” said the entrepreneur of pedigree. Who pays the cost of late ‘realization’? Whose money is it anyway? How many entrepreneurs get that luxury of such occasional ‘realizations,’ but nothing to lose and remain celebrated as successful entrepreneurs? How often a Unilever leadership (or anyone owning multiple brands) would think that brand building would be easier if they owned a media brand also? And cut a cheque of few millions, lose it all, face no heat from investors and get away with it?

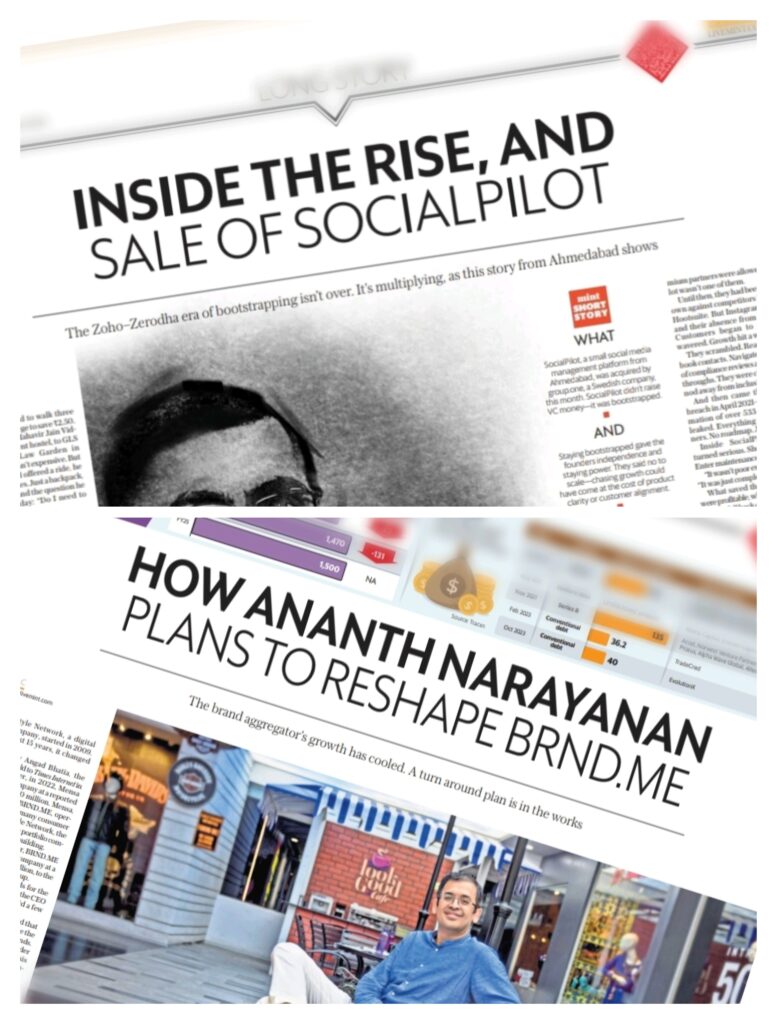

Two long read business stories in Mint, published just six days apart in the month of July 2025, show the stark contrast between two business philosophies in Indian start-up eco system. And, the contrast between who gets the limelight and who does not.

One is the story of SocialPilot, a relatively unknown, bootstrapped product company from Ahmedabad that is painstakingly built with focus and frugality, which was later successfully acquired by a Swedish firm. Even after the acquisition, there is no noise or celebrations. They continue to build quietly.

And the other is the kind of story we are more familiar with. The one that gets more media attention. Raising money is our mark of success kind.

In a relatively risk-averse society (or at least that’s the general perception), where people are looking for stable jobs (when there are no jobs), we are often called upon to be entrepreneurs (job creators) and not job seekers (rightfully and well-intended). But the narratives on business growth in the post-internet era have changed dramatically. It is scale at all costs. At the root of this is that the marginal cost for an additional output is supposedly low in internet-enabled business, but achievable only at very large scale. Someday, when the scale is very high, we will be profitable.

Till then, get investors to be generous. The investor thesis (as I learned from a few people) is that eight out of 10 investments will go up in flames. But the two will give outsized returns to cover up for the other eight.

So, the effort now, and the mark of success is with respect to the investor, not as much to the consumer or about building a meaningful business. How fast and big your money raise is. All the headline-grabbing stories of the last decade was just this. They are the ‘sharks’ and the ‘celebrity innovators.’ Then there are heroes who can continuously raise money despite the mounting losses of the company they are running, and yet part of the raised money goes to setting up venture funds (I don’t understand how this works).

And occasionally we come across stories such as of SocialPilot, grounded with strong business fundamentals and founders who keep their heads down and build quietly. There may be a thousand of them, but we don’t get to hear those stories often.

Sample some anecdotes from these two stories that shows the stark difference:

“… in a country where millions dream of building something of their own, most won’t raise capital. They won’t make it to Shark Tank. They won’t chase blitzscale. Some will build-quietly, profitably, and for the long haul” [SocialPilot story]

“Based on the premise of scaling of these brands, the parent company bagged a little over $200 mn in funding” (after acquiring 24 brands in 4 years) [Brnd.me story]

“… frugality isn’t about saying ‘no’. it is about being intentional. … they didn’t build around funding. They built around cashflow. … business wasn’t built on debt. You spent what you earned. You scaled only as far as your profits allowed.” [SocialPilot story]

“… overall brnd.me has raised around $283 million. … However as the funding tap dried, the company went into a cash preservation mode. … one lesson learnt is that focus helps” [Brnd.me story]. After burning $283 million, when the ‘tap dried,’ they realized that focus and cash preservation are important in business. What a revelation and display of management genius! Shouldn’t this be a case study in management institutes for its profound wisdom?

“… that chasing growth would come at the cost of product clarity, team sanity, or customer alignment” [SocialPilot story]

“… the company has (now) identified high potential companies and doubled down on them to improve its top and bottom lines.” [Brnd.me story]. So blitzscaling didn’t help in focus, neither it didn’t help in identifying high potential companies at the time of acquiring itself.

So, what entrepreneurial lessons do we want to learn and teach? And which entrepreneurs should get celebrated?

_____________________________________________________________________________________

Link to the Mint stories (behind paywall)